Guest Post: How this Combat Veteran replaced his income with Airbnb!

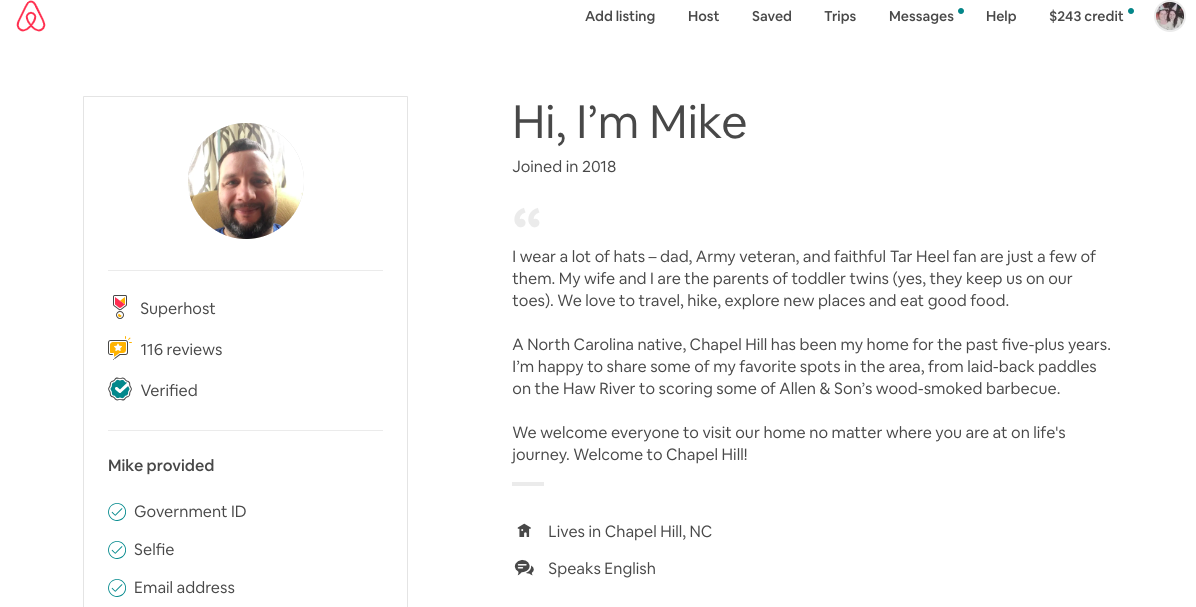

Meet Mike!

Hello friends!

This story absolutely warms my heart to tell.

It can be a little lonely over here on the other side of the screen and every once in while, when I think no one is reading, I get a lovely little note like this one:

Received on Christmas Eve nonetheless! You can see that I put it in my “Feel Good” Folder.

And just like that we became pen pals. Mike would update me on his progress every 6 months or so and I cheered him on, excited to see how he was succeeding. I asked him to share his story with you because I find it such an excellent example of how when the right opportunity drops in your lap, you just put your head down, educate yourself and keeping moving forward.

Thank you Mike for opening your world to us in such a well written way! You are an inspiration to us all!

—

It’s funny how life works out sometimes.

Ralph Waldo Emerson once wrote, “Be not the slave of your own past - plunge into the sublime seas, dive deep, and swim far, so you shall come back with new self-respect, with new power, and with an advanced experience that shall explain and overlook the old.”

This is how I choose to look at my path to FIRE.

Background

I graduated West Point a year before 9/11, and I spent the next eight years in and out of combat. After my fourth tour, in 2008, the Army sent me to graduate school in Monterey, CA for some rest and relaxation. I had been going so hard and so fast that I didn’t realize that I was burned out physically, mentally, and spiritually. For the first time in my life, I couldn’t perform. I floundered in school. The doctors would later diagnose a mild Traumatic Brain Injury or too many concussions from college rugby, jumping out of airplanes, roadside bombs, and suicide bombers.

The Dark Days

I’d spend the next four years in physical rehab regaining my balance and relearning math. After a time, I exited the military and had to find a new way. I never knew what I wanted to be when I grew up. In the Army, I found that I was good at leading and taking care of others, but I could never answer the question, “What do I want?” So, I jumped into the corporate world and started a career in technology. I found that I was really good at both Agile Coaching and Product Management, and my career took off over the next five years.

But, I wasn’t happy, and I didn’t know what to do.

I decided to make a change. I wasn’t sure where to go, but I knew it had to be different. Otherwise, I would die a slow death in a cubicle. It was time to work for myself.

Back in 2016, I had a big work trip with eight Italian coworkers to Denver. Due to the cost savings and the chance for team building, I elected for us to stay in an AirBnb instead of separate hotel rooms. The numbers that the homeowners made stuck with me. In the back of my mind, I always wondered, “Why can’t I do that?”

Finding Another Way

In late 2017, I did a lot of research on the interwebs, and I eventually stumbled onto Bigger Pockets, Mr. Money Mustache, and 1500days. I was hooked- I had found my people. Then, I found Zeona’s blog, and the fog lifted. Reading through her story and playbook, I began to see a path ahead.

Entering the real estate market at or near the peak involves some creativity if you want to build a company built to last. For initial strategy, I would use a combination of BRRR and Airbnb as a means to add value and build up equity.

For initial market, I would stay local in Chapel Hill modeling Zeona’s approach- University town, hospital, tech hub, and international airport. This market minimizes risks of traditional vacation rentals. In a recession, we still have professors, doctors, nurses, and parents traveling to the area. On the surface, the Airbnb market seemed flooded in my area. But, as I would learn, Orange County has roughly one million visitors a year. Additionally, most host were running their listings as a hobby rather than as a business. They entered in the early days when you could throw a listing on the web and make big money. Thanks to Zeona’s tips, I realized that I could gain competitive advantage and differentiation through a solid customer experience and maximizing technology apps for acceleration (real-time pricing, marketing automation, etc…).

First Deal- The Barclay- BRRR

In December 2017, after analyzing about 300 properties, I found a good candidate- a small, dated 3/1 bungalow one mile from downtown. It had been on the market for seven months, and it missed the main buying season (Mar-Aug). The owners were out-of-state and had purchased it back in 2008 when their kid was at university. They were ready to get rid of it. I was able to negotiate a price about $20k below appraisal and tax value. I put $50k in for the rehab, and initial value add was around $40k. For financing, I used a HELOC from our primary home for down payment and rehab, financed a 30 year mortgage from the bank, and spent about $30k out of pocket.

Speed to market was what I wanted. From house closing (Feb 2018) to AirBnb launch (Apr 2018), we were at 50 days. Once it launched, we were off to the races.

With the earned cash flow from last year and the benefits of the new tax laws (bonus depreciation), I regained my initial investment In March because the rehab offset my W2 earnings.

After reviewing options with the bank, I elected not to refinance. I decided to keep the mortgage payments low, focus on paying down the HELOC, and building equity.

Over the next five months, I would learn how to run the business: bookkeeping, cleaning, guest prep, guest communications, repairs, etc… I did everything by myself so I could learn what right looked like.

More importantly, I was discovering joy at work. I found that I loved every aspect of the business from acquisition to rehab to helping folks enjoy their trip to Chapel Hill.

Second Deal- The Carrboro- Rent to AirBnB

In July 2018, I started calling around to every open rental on Zillow. After sixty days and about 100 no’s, I found a landlord that was willing to allow me to lease and AirBnb. I secured a 4 bedroom / 4 bathroom house.

We launched in October 2018. Initial investment was around $9000. It begin generating a profit. in March.

Additionally, I hired a cleaner to clean on the weekends to free up my time. As things progressed, she would take over all cleanings.

With the business model getting validated, I was close to leaving the regular day job. As fate would have it, my company had a massive layoff and gave me a small severance. I smiled, rolled the money into the business, and kept moving forward.

I was now free.

Third Deal- The Beechwood - Commercial Lease

In December 2018, I was starting to look for my next property, and one fell into my lap. A friend was renting out one of his townhouses. I called and discussed my business, and he was on-board.

To make it more official, we had a lawyer draft a five year commercial lease that would protect both of us in the event that things go wrong.

The Beechwood launched in January.

Initial investment was $6000. It should break even in June and start generating a profit.

Fourth Deal- The Duplex

This month, as the market has tightened up, I was not actively looking to purchase another property. But, a duplex opened up on Franklin Street, and the initial numbers worked. It seemed perfect- prime location, legal duplex, twenty year history of short term rentals, and five spaces for student parking for other income.

I called the owner and got it under contract. Initial plan was a partial rehab to launch quickly. Over two weeks of due diligence, I had two inspectors, one structural engineer, two general contractors, one licensed plumber, and one licensed electrician review the property. Their findings are that every major system is end of life, and I would need to conduct a full rehab. Rehab cost has escalated from $30-$40k to $60-$70k.

Two days before closing, the Subject To Appraisal came back $10,000 below my low estimate.

I still had the ability to close the deal and move forward. My ego told me to push through and make it work. However, the numbers no longer worked for me. I slept on it. The next morning, I got up and walked away from the deal.

Total investment: $5000

I learned how to say no and not rush to failure.

Next Steps

I’m off to a good start with the AirBnb’s, and I haven’t had this much fun in years. Right now, my focus is on recession proofing. I’m looking to pay down debt, increase cash reserves, and wait patiently for the next opportunity to buy at a discount.

On the real estate side, I’m researching accessory dwelling units (ADU’s) and companies such as Studio Shed.

My wife and I have about six different revenue streams now, and I’m going to pick up some consulting work helping some friends of mine that work with hardware, health care, and other industries to adopt software development practices across their organizations.

Lessons Learned

Zeona was a great help to me. If you are interested in learning how to build your own business, I’d highly recommend hiring her for some consulting.

On the AirBnb front, here’s some lessons that I learned in the first year,

Revenue is not profit. Watching the Netflix shows about short term rentals is funny. You can spend a lot of money creating a beautiful vacation rental, and you can find out that you are paying for your guests to stay there. Be mindful of expenses!

Beware of the guest asking for a discount. This one was counter-intuitive for me particularly because I’m a people-pleaser and like helping others. But, I’ve learned that if someone begins their initial conversation with you by asking for a discount or a favor, the demands will never end. Over time, you’ll gain intuition on how to filter guests, but this one is a good start point.

Just do the Basics well. What are the keys to my success? It’s surprisingly simple- keep the house clean, keep the house stocked with toilet paper, coffee, and extra towels, and be prompt, kind, and respectful with your guests.

Contacting Me

Strive Rentals- new website. Still in beta.

Email- mike@strivesolutionsllc.com

—

TAKE ACTION: